Deferred tax calculation

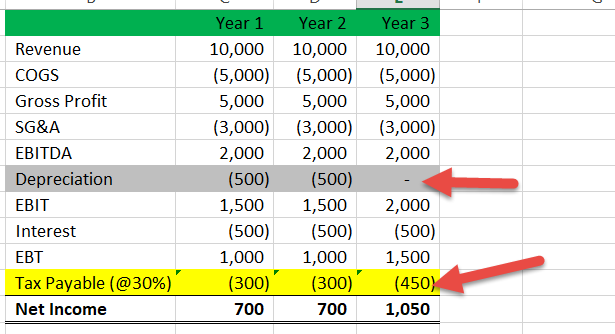

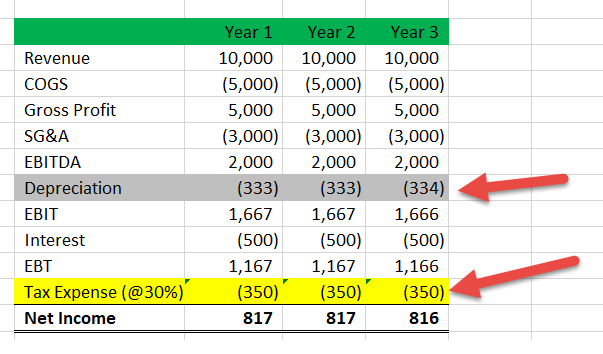

Year 1 DTL 350 300 0 50. Quickly learn licenses that your business needs and.

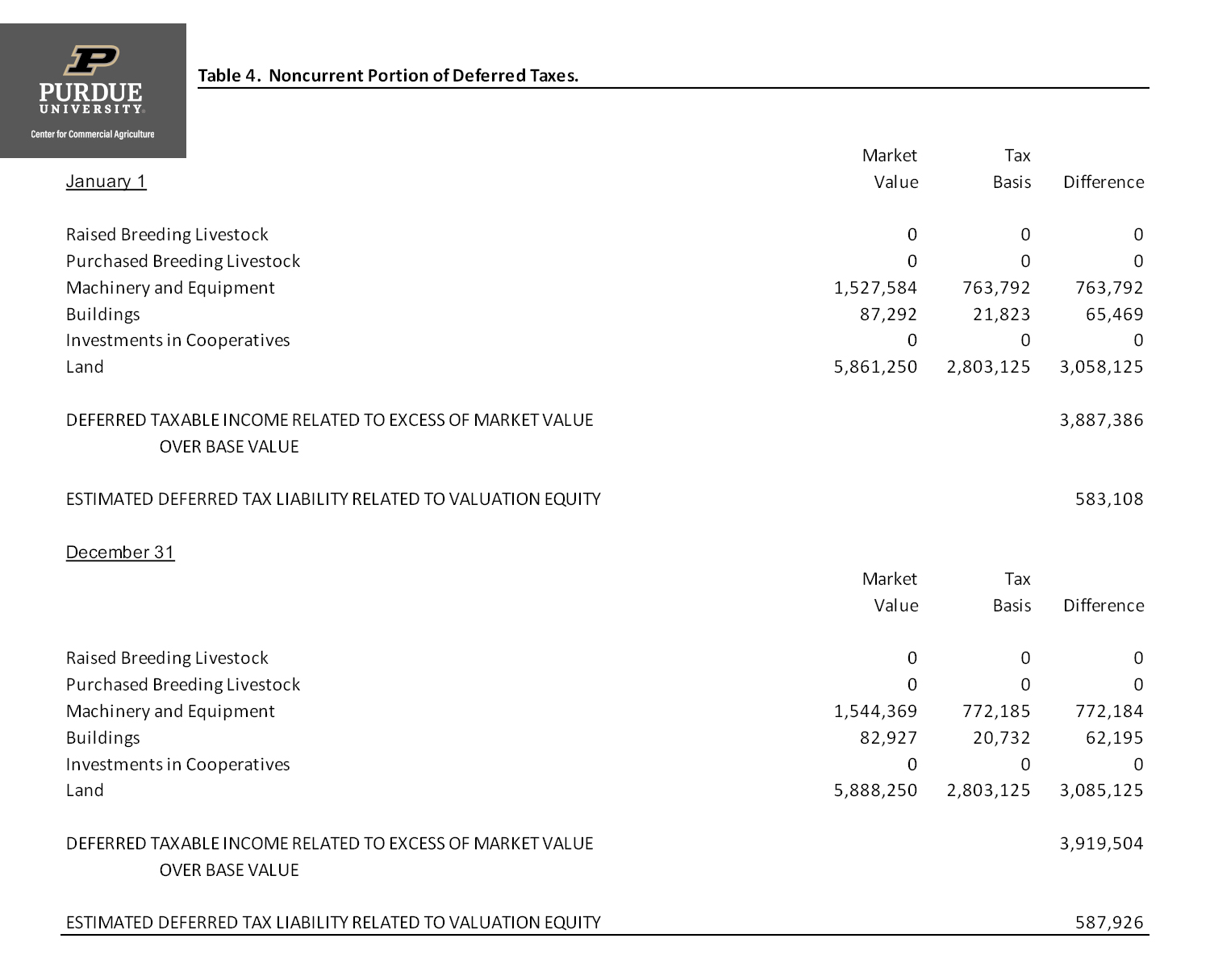

Computation Of Deferred Tax Liabilities Center For Commercial Agriculture

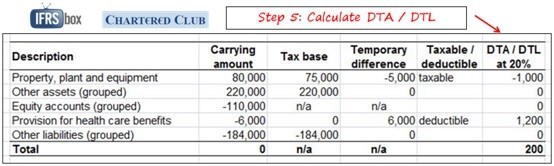

Step 3 Calculation of deferred tax identification of the appropriate tax rate.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. Apply more accurate rates to sales tax returns. Request Your Demo Today. Deferred tax refers to the tax which shall either be paid or has already been paid due to transient inconsistency between an organisations income statement and tax statement.

Click here to view relevant Act Rule. Search by state to find your employer-sponsored deferred compensation plan administered by Nationwide Retirement Solutions. Ad Reduce Risk Drive Efficiency.

The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you look up sales tax rates and calculate the sales tax owed on a taxable purchase for anywhere in the United States. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Deferred tax is the tax that is levied on a company that has either been deducted in advance or is eligible to be carried over to the succeeding financial years.

Depreciation rate as per the Income Tax Act 15. Year 3 DTL. Find your employers plan.

Free Calculator to Help Compare Taxable Investment to 2 Common Tax Advantaged Situations. IAS 12 requires deferred tax assets and liabilities to be measured at the tax rates that are expected. Ad Calculate and Compare a Normal Taxable Investment to Two Common Tax Advantaged Situations.

As amended upto Finance Act 2022 Deferred Tax Calculator. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. The carrying amount will now be 2500 while the tax base remains at 600.

Year 2 DTL 350 300 0 50. See it In Action. Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous.

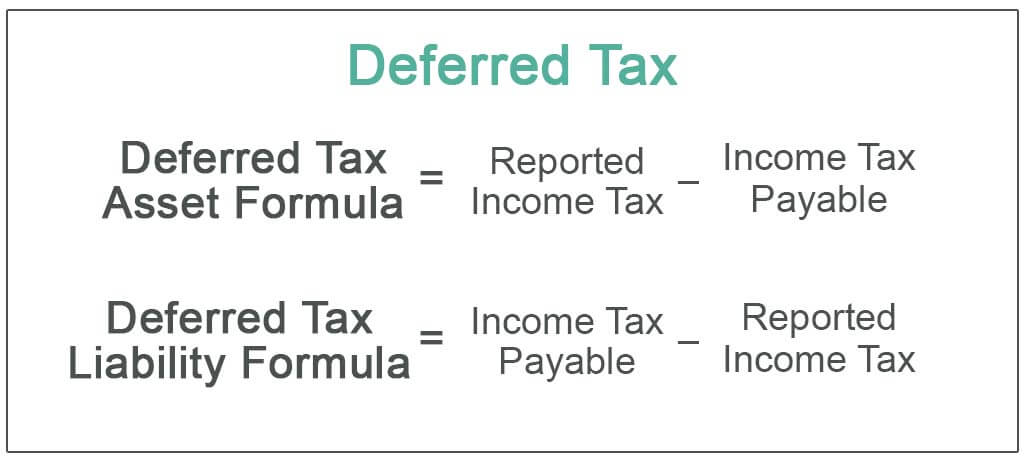

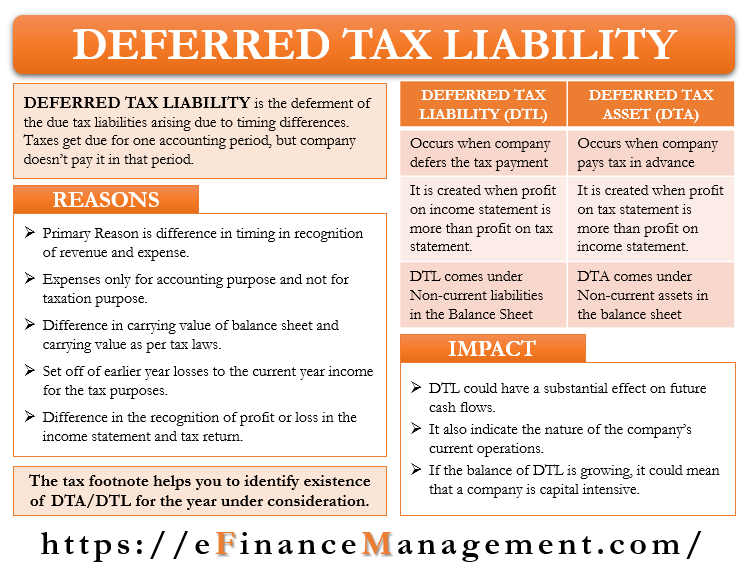

Deferred Tax Liability Formula Income Tax Expense Taxes Payable Deferred Tax Assets. Difference to calculate the deferred. There is therefore a temporary difference of 1900 of which 1500 relates to the revaluation surplus.

Know more about its types. Cost Rs. Calculate deferred tax asset or deferred tax liability.

Depreciation rate as per the Companies Act 10. Get information about sales tax and how it impacts your existing business processes. In the last column of the table ABC can calculate its deferred tax asset or liability.

As the taxable temporary differences give rise. Tax status of the company. Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. For the financial year 2020-21 the.

Deferred Tax Meaning Expense Examples Calculation

Deferred Tax And Temporary Differences The Footnotes Analyst

Ias 12 Example Incl Deferred Tax Acca Financial Reporting Fr Youtube

Define Deferred Tax Liability Or Asset Accounting Clarified

Deferred Tax Liabilities Meaning Example How To Calculate

Tax Calculation And Reporting Story Behind Sample Content Part 1 Sap Blogs

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Deferred Tax Liabilities Meaning Example How To Calculate

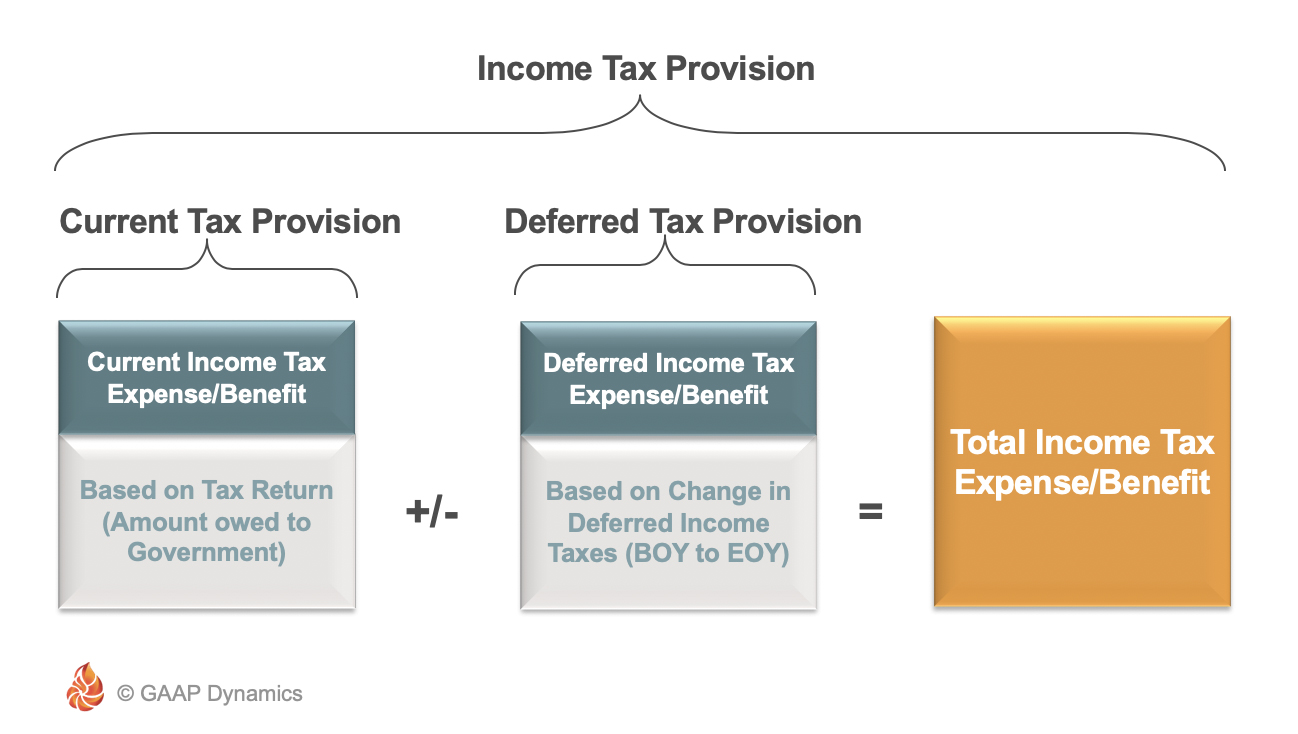

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Calculation Of Deferred Tax Download Table

Net Operating Losses Deferred Tax Assets Tutorial

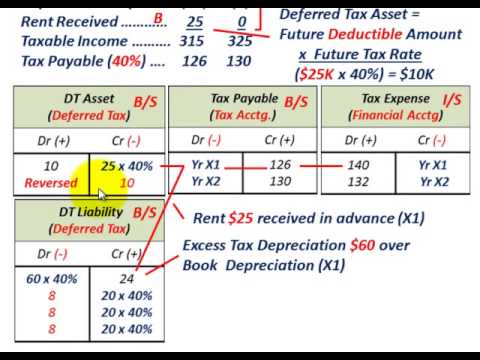

Deferred Tax Example Two Temporary Differences Deferred Tax Asset Deferred Tax Liability Youtube

Deferred Tax Calculation Excel Rocktheme

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Deferred Tax Liabilities Meaning Example Causes And More

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition